Introduction

When it comes to securing venture capital (VC) funding in the UK, having an impressive financial model can make or break your chances. UK investors, particularly those focused on tech, fintech, SaaS, and sustainability startups, want more than just an exciting idea—they need a clear, data-driven financial plan that demonstrates your startup’s ability to scale, generate revenue, and achieve profitability.

A well-prepared financial model not only highlights your growth potential but also shows investors how their capital will be used, when they can expect returns, and what milestones your startup plans to achieve. In this guide, we’ll walk you through how to build a VC-ready financial model that boosts investor confidence and increases your chances of securing funding.

📈 1. Key Components of a Strong Financial Model

A solid financial model should provide a comprehensive view of your business’s financial health and future growth. When presenting to UK investors, ensure your model includes the following essential components:

✅ 1.1 Revenue Projections

Investors want to see how your startup plans to generate revenue over the next 3-5 years. Break down revenue streams clearly and use realistic assumptions about customer growth, pricing models, and market demand.

👉 Tip: Include multiple revenue streams if applicable (e.g., subscription fees, transaction charges, licensing, etc.).

✅ 1.2 Cost Structure

Clearly outline your fixed and variable costs. Investors want a breakdown of:

- Salaries and wages

- Operational expenses

- Marketing and customer acquisition costs

- Technology and infrastructure costs

👉 Tip: Differentiate between fixed costs that remain stable and variable costs that scale with growth.

✅ 1.3 Customer & Sales Forecast

Estimate how many customers you expect to acquire and at what growth rate. Include assumptions about conversion rates, churn rates, and customer acquisition costs (CAC).

👉 Tip: Demonstrate how you plan to reduce CAC and increase customer retention to improve Lifetime Value (LTV)over time.

✅ 1.4 Cash Flow Statement

A well-structured cash flow statement shows your projected inflows and outflows, helping investors assess whether your startup has enough runway to hit critical milestones.

👉 Tip: Highlight how much funding is required and when you expect to hit break-even.

✅ 1.5 Profit & Loss (P&L) Statement

Your P&L statement should show projected revenue, expenses, and profitability over the next 3-5 years. Investors want to see a clear path to profitability with detailed assumptions.

👉 Tip: Break down revenue by product line or customer segment to show diversified income sources.

✅ 1.6 Break-even Analysis

Identify the point at which your revenue covers your operating costs and your startup becomes profitable. Break-even analysis helps investors gauge when they can expect returns.

👉 Tip: Highlight assumptions behind your timeline to break even and the key milestones that will get you there.

🔎 2. What UK Investors Look for in a Financial Model

To impress UK investors, your financial model needs to check all the right boxes. Investors are looking for realistic, data-backed projections and a clear understanding of how their investment will fuel growth.

📌 2.1 Realistic and Data-Driven Assumptions

Avoid overly optimistic projections—investors will challenge unrealistic growth rates and cost structures. Base your assumptions on market data, industry benchmarks, and customer feedback.

👉 Tip: Include sensitivity analysis to show how different scenarios (best-case, worst-case, and base-case) could impact your projections.

📌 2.2 Scalability and Path to Profitability

UK VCs prioritize startups that can scale efficiently. Show how your customer acquisition strategy will drive growth without significantly increasing costs. Highlight when and how you plan to hit key scalability milestones.

👉 Tip: Demonstrate your unit economics by comparing Customer Acquisition Cost (CAC) with Lifetime Value (LTV) to show sustainable growth potential.

📌 2.3 Clear Funding Requirements and Allocation

Investors want to know how much funding you need and how it will be allocated. Be clear about:

- Amount of capital required

- How the funds will be used (e.g., product development, sales, marketing, regulatory compliance)

- The expected runway before the next funding round

👉 Tip: Clearly explain how the funding will accelerate growth and help you hit the next funding milestone.

📊 3. Advanced Tips to Make Your Financial Model Stand Out

🔥 3.1 Highlight Key Performance Indicators (KPIs)

Include relevant KPIs that align with your business model, such as:

- Monthly/Annual Recurring Revenue (MRR/ARR)

- Churn rate and retention rates

- Gross margin and customer acquisition cost

👉 Tip: Tailor KPIs to your industry—SaaS companies should emphasize MRR/ARR, while e-commerce startups should highlight average order value and conversion rates.

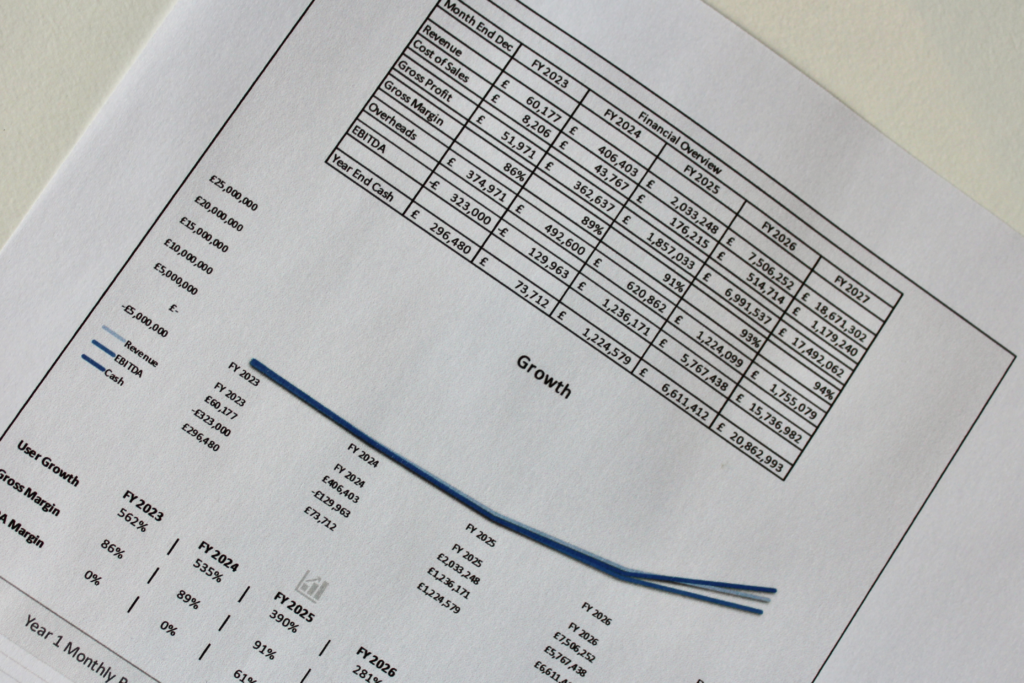

🔥 3.2 Use Visuals to Simplify Complex Data

Investors don’t want to sift through spreadsheets—use charts, graphs, and visuals to highlight key insights and trends.

👉 Tip: Include visual representations of revenue growth, burn rate, and customer acquisition progress.

🔥 3.3 Incorporate a Sensitivity Analysis

A sensitivity analysis shows how changes in key assumptions (e.g., pricing, customer acquisition, churn) can impact your financial projections. It demonstrates that you’ve accounted for potential risks.

👉 Tip: Present both best-case and worst-case scenarios to highlight your risk management strategy.

📝 4. How to Structure Your Financial Model for Investor Presentations

When presenting your financial model to UK investors, simplicity and clarity are key. Follow this structure to ensure your model resonates with investors:

- Executive Summary: Briefly highlight key metrics, funding ask, and growth potential.

- Revenue Model: Breakdown of revenue streams and pricing strategy.

- Cost Structure: Fixed and variable costs with growth-driven adjustments.

- Customer Acquisition Strategy: CAC, LTV, and churn rates.

- Cash Flow and Profitability Timeline: Show runway, burn rate, and time to break-even.

- Funding Allocation: Where the capital will go and how it will accelerate growth.

🎯 5. Conclusion: Build Investor Confidence with a Robust Financial Model

A well-crafted financial model gives UK investors the confidence that your startup is prepared to scale and manage capital effectively. By demonstrating realistic projections, a clear path to profitability, and well-defined funding needs, you increase your chances of securing venture capital.

🚀 Need an Investor-Ready Financial Model?

ModelsForStartUps.com offers:

✅ Pitch Deck Templates – Designed to impress investors.

✅ Business Plan Templates – Structured plans for SaaS fundraising success.

✅ Financial Model Templates – Projections that VCs expect.

✅ Cap Table Templates – Track ownership and equity with ease.

📈 Explore our templates today and give your startup the edge it needs to secure funding!

📌 #StartupFinance #FinancialModels #VCFunding #InvestorReady #SaaSStartups #FintechStartups #SustainabilityStartups #PitchDecks #FundingStrategy #BusinessPlanning #ModelsForStartUps #SeriesAFunding #StartupSuccess